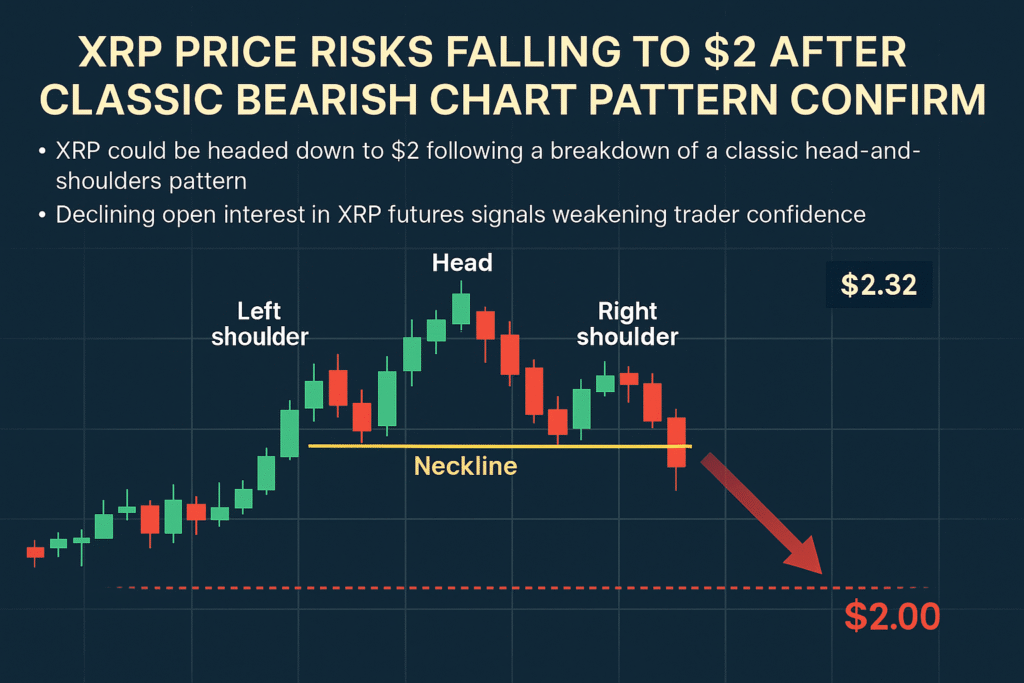

XRP price breaks below key support, confirming a bearish head-and-shoulders pattern. Analysts warn of a possible drop to $2 or lower amid weak trader sentiment.

XRP Price Risks Falling to $2 After Classic Bearish Chart Pattern Confirms

May 19, 2025 | CryptoAIUpdates News Desk

XRP is flashing strong bearish signals this week after confirming a classic head-and-shoulders (H&S) pattern breakdown, triggering fears of a decline to $2 or lower.

XRP Confirms Bearish Pattern — $2 in Sight?

On May 19, XRP broke below the neckline support at $2.33, confirming a head-and-shoulders pattern on the 4-hour chart. This bearish setup typically forecasts a trend reversal, and traders are now watching for a possible 14% drop from current levels.

Analysts suggest that the next critical levels include:

- $2.25: 200-day simple moving average

- $2.00: Bearish pattern’s technical target

- $1.60: Extreme case scenario (per analyst Egrag Crypto)

“If XRP fails to reclaim $2.30, a steep selloff toward $2.15 or even $1.60 could follow,” Egrag warned in a chart shared on X.

XRP Futures Open Interest Drops $1B in 5 Days

The recent bearish confirmation coincides with a steep 18% drop in open interest, from $5.49B to $4.49B, in the last five days. The decrease in XRP futures positions signals waning confidence among traders.

Additionally:

- Over $12 million in long positions were liquidated in the last 24 hours

- Trading volume surged 70% to $4.1 billion, signaling bearish pressure intensifying

Support and Resistance Levels to Watch

| Level | Significance |

|---|---|

| $2.30 | Neckline of H&S, must hold to avoid drop |

| $2.25 | 200-day SMA support |

| $2.00 | Measured move target from H&S |

| $1.60 | Extended bear target (worst-case) |

While the H&S pattern suggests downside continuation, a bounce back above $2.33 would invalidate the bearish structure and offer bulls a chance to regain momentum.

Conclusion

With XRP trading at $2.32, the next few sessions will be critical. Bulls must defend the $2.30 support zone to avoid further sell-offs. Failure to do so could result in a multi-layered drop to $2 or below, especially with long positions liquidating and trading volume surging on down moves.