Despite rising DApp revenues, the crypto market still values blockchains more, viewing them as the core infrastructure for long-term ecosystem growth.

Date: 21 May 2025

In the ongoing crypto value debate, infrastructure wins.

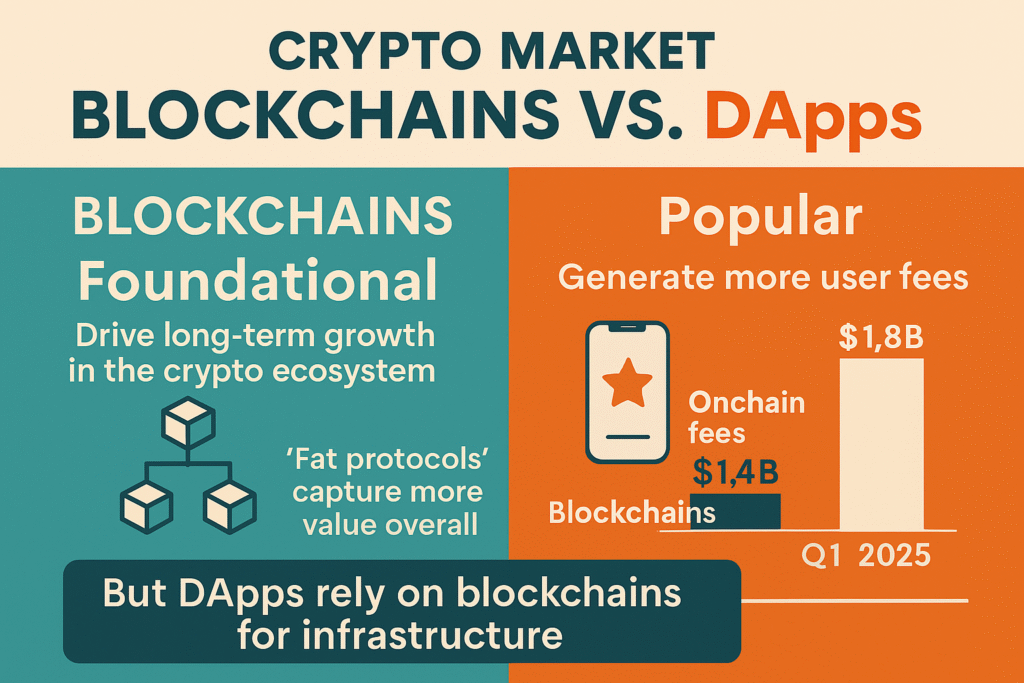

A growing number of analysts argue that while decentralized applications (DApps) generate immediate user activity and revenue, the true long-term value of crypto lies in its blockchains — the foundational layer powering the entire ecosystem.

A report released today highlights that although DApps attract users and fees, they cannot function without the blockchains they operate on. As one analyst noted:

“Blockchains may have built the roads — but the apps are building the cities.”

Still, apps alone don’t define market value. The crypto market rewards sustainable infrastructure. Without the “roads” laid by chains, these app-built cities become unreachable.

In Q1 2025, DApps generated $1.8 billion in fees — more than the $1.4 billion earned by blockchains — suggesting rising popularity. Yet the broader crypto market cap still assigns more worth to blockchains. As of 2024, they controlled 70% of the total crypto market cap, earning over $6 billion in annual fees.

Why? Because blockchains are the trust layer.

They anchor decentralized apps by timestamping interactions, verifying transactions, and offering secure, immutable records. Without blockchains, there’s no way to trust a DApp interaction at scale.

The app-chain model reinforces this thesis. Resource-hungry applications now deploy modular appchains — specialized blockchains that enhance scalability and reduce latency. Each appchain needs independent computational power, storage, and consensus — revalidating the irreplacable role of blockchain architecture.

Crypto strategist Joel Monegro once proposed the “fat protocol” theory — that protocols capture more value than apps. Although revenue metrics like DApp fees challenge this thesis, the broader infrastructure-based value capture remains valid.

In 2025, crypto markets are maturing. Stakeholders now view value not just in dollar signs, but in resilience, scalability, and interoperability. This deeper understanding favors blockchains, even when DApps deliver higher immediate returns.

“Blockchains are not competing with DApps — they are enabling them,” the report concludes.

As the market grows, collaboration between protocol and application layers will be key. But when it comes to foundational value, chains remain the cornerstone.