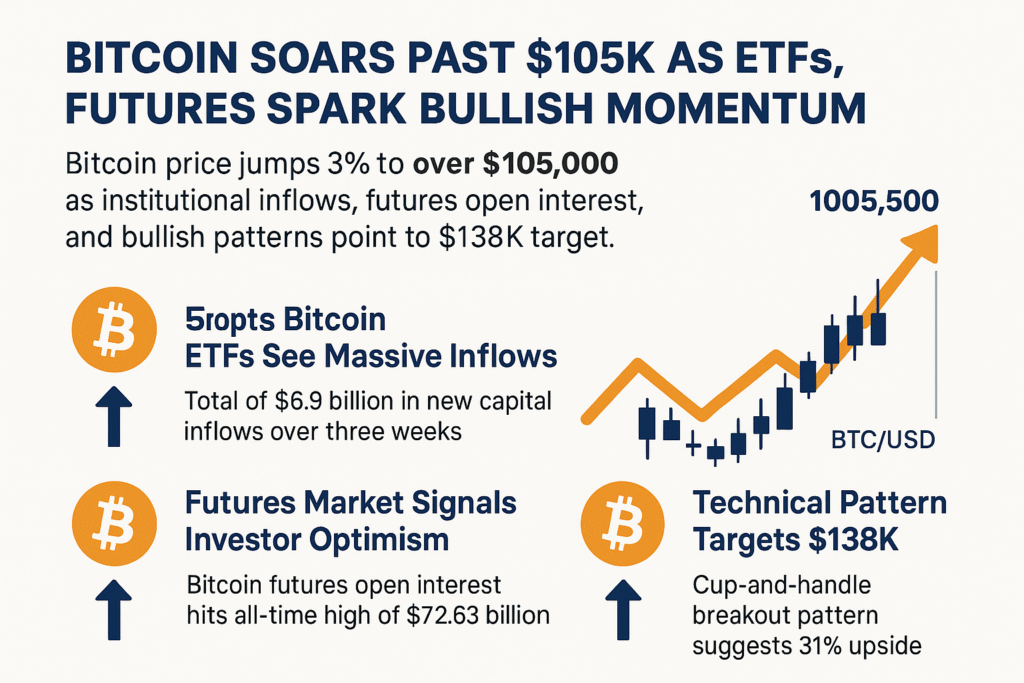

Bitcoin price jumps 3% to over $105,000 as institutional inflows, futures open interest, and bullish patterns point to $138K target.

Bitcoin Soars Past $105K as ETFs, Futures Spark Bullish Momentum

May 20, 2025 — Bitcoin (BTC) surged over 3% today, breaking the $105,000 barrier and peaking at $107,148, fueled by renewed institutional interest and strong futures market activity. According to data from Cointelegraph and TradingView, BTC/USD rose from a low of $102,100 on May 19 to an intraday high of $107,148 today.

Spot Bitcoin ETFs See Massive Inflows

The rally aligns with robust inflows into U.S. spot Bitcoin ETFs. Farside Investors reported 18 days of inflows out of the past 21, totaling $6.9 billion in new capital. This trend reflects growing institutional demand for regulated exposure to Bitcoin.

CoinShares also revealed $785 million in crypto investment product inflows last week alone, with $557 million directed toward Bitcoin. Strategy (formerly MicroStrategy) purchased 7,390 BTC, while Japan’s Metaplanet added 1,004 BTC, reinforcing bullish sentiment.

Futures Market Signals Investor Optimism

Open interest (OI) in Bitcoin futures soared to a record $72.63 billion on May 20, up from $57.1 billion a month earlier, according to CoinGlass. CME futures OI also hit a 90-day high of 157,875 BTC, signaling leveraged bets on further price gains.

Historically, such OI spikes have preceded major price moves. A similar trend between October and December 2024 led to an 84% rally, culminating in BTC’s then all-time high of $108,000.

Technical Pattern Targets $138K

Technically, Bitcoin is forming a cup-and-handle pattern on its daily chart. This bullish setup suggests a breakout move, with the next resistance near $109,000. A confirmed breakout above this neckline could send Bitcoin to $138,000, a potential 31% surge from current levels.

What’s Next for BTC?

With both institutional inflows and bullish technicals in alignment, Bitcoin appears poised for further gains. Analysts believe BTC could test $116,000 later this week if momentum sustains.

📢 Stay Updated:

Subscribe to our newsletter for daily crypto price alerts and expert insights.