Bitcoin hits $111K with strong buyer activity and low profit-taking, signaling potential for continued bull run in 2025.

Published on May 23, 2025

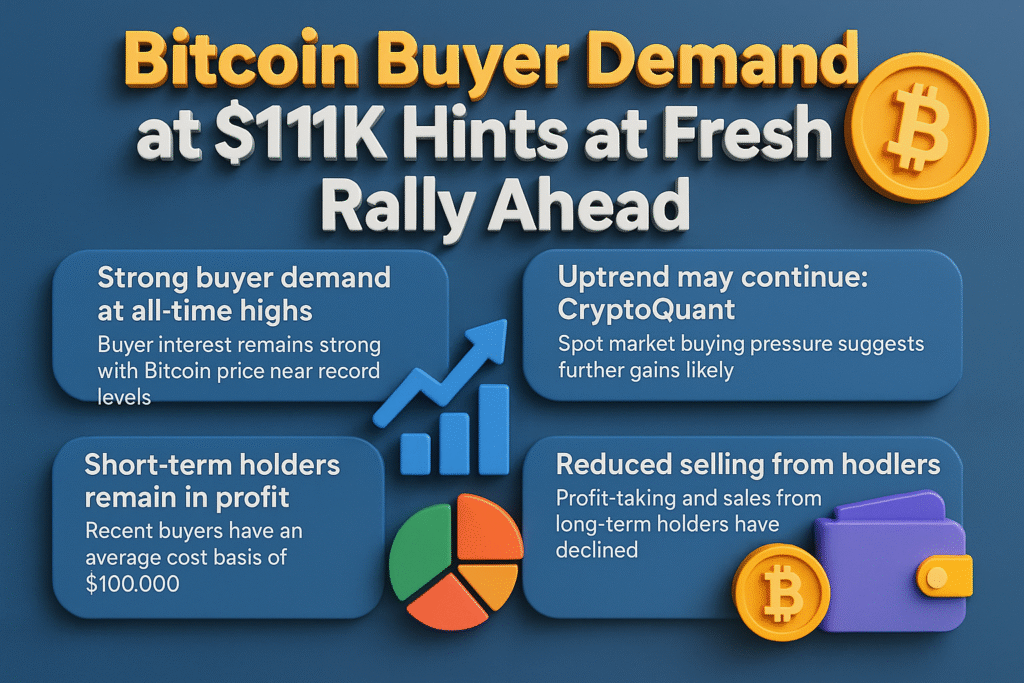

Bitcoin is soaring to new all-time highs, reaching $111,299 today, with data signaling that this rally may just be getting started. According to a new report from CryptoQuant, buyer dominance remains strong even as BTC pushes into uncharted territory, suggesting another bullish wave could be on the horizon.

Onchain data reveals that the 90-day cumulative volume delta (CVD) on spot exchanges favors taker buy orders—highlighting that buyer pressure continues to outweigh selling activity. This trend has been growing stronger since early May, following a period of neutral market behavior.

“In short: Buy orders have become dominant again,” noted CryptoQuant contributor Ibrahim Cosar. “This generally signals that the uptrend may continue.”

This behavior marks a shift from earlier in the year, when Bitcoin retraced below $75,000 after reaching $100K in December 2024. At the time, selling pressure dominated the market. But now, with BTC trading 50% higher, the order book shows renewed buyer confidence.

Spot Market Shows Persistent Strength

Unlike previous peaks, this current rally sees sustained interest from investors, with short-term holders still firmly in profit. The average cost basis for recent buyers hovers just under $100K, and reclaiming this level has historically been a buy-the-dip signal.

As noted by CryptoQuant, Bitcoin’s rally gained momentum after crossing this short-term holder average cost—indicating a bullish confirmation for many traders.

Hodlers Stay on the Sidelines

Adding further bullish support is the behavior of long-term holders. According to Glassnode, older Bitcoin coins remain inactive, and daily profit-taking activity is down nearly 50% compared to December’s $100K milestone.

This reduced selling pressure—despite higher prices—demonstrates confidence among long-term investors. Glassnode highlighted in an X post that “older coins were much less active this time, signaling stronger holding behavior.”

Market Outlook

The continued optimism among Bitcoin investors, coupled with limited profit-taking and dominant buyer volume, sets the stage for further price appreciation. With momentum still favoring bulls and resistance levels breaking, analysts are eyeing possible targets beyond the $115K mark.

CryptoQuant concludes that the current buyer-driven rally is well-positioned to continue, particularly if Bitcoin sustains above its short-term cost basis and liquidity remains favorable.