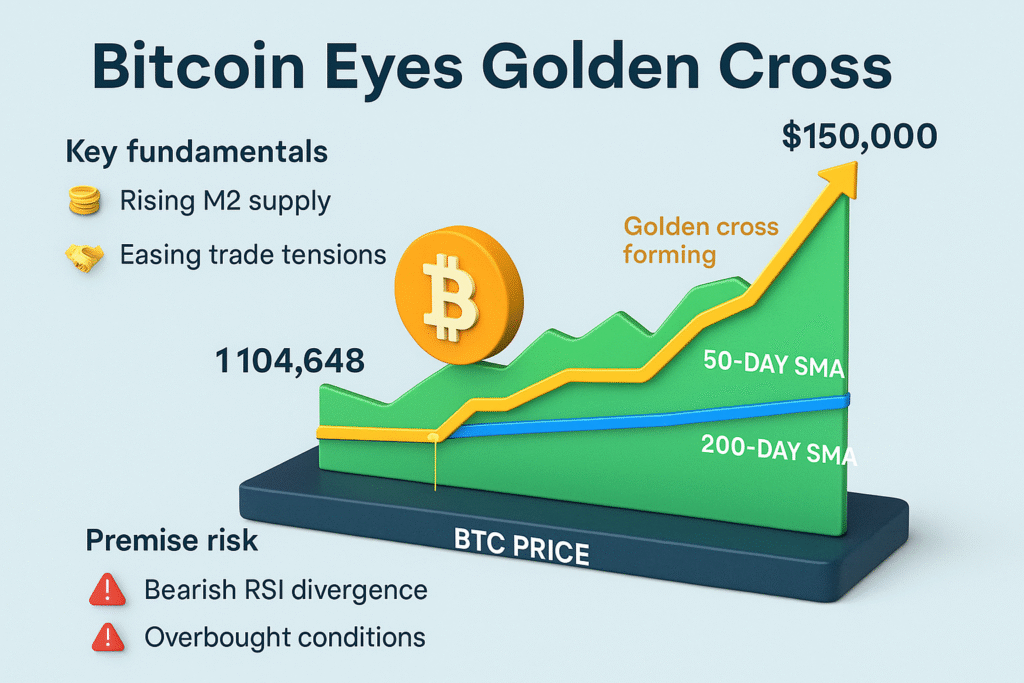

Bitcoin is nearing a golden cross for the first time since 2024, historically signaling major rallies. Will BTC repeat past gains or face a pullback below $100K? A look at the indicators.

Bitcoin Eyes Golden Cross as Technical Signal Hints at $150K Rally Potential

May 20, 2025 – CryptoDesk

Bitcoin (BTC) is on the verge of forming a golden cross, a key technical signal that has historically preceded major price rallies in the crypto market — but not without caveats.

As of May 20, Bitcoin is trading around $104,648, and its 50-day simple moving average (SMA) is poised to cross above the 200-day SMA by the end of the month. If confirmed, this would be Bitcoin’s first golden cross since October 2024.

“Golden crosses typically suggest strong momentum,” notes crypto analyst Michaël van de Poppe, “but they must be confirmed with other market signals to avoid bull traps.”

History Says: Golden Cross ≠ Guaranteed Gains

Golden crosses have previously been followed by impressive BTC surges:

- October 2023: Bitcoin soared 45%, fueled by ETF excitement.

- September 2021: A similar crossover led to a 50% gain.

- Early 2021 and 2019: Both saw sustainable rallies.

However, it’s not always bullish. In February 2020, a golden cross was followed by a sharp 62% crash due to the COVID-19-induced market panic. This serves as a reminder that while golden crosses are bullish signals, they aren’t immune to macro shocks.

Fundamentals Add Fuel — But RSI Warns Caution

Currently, macro indicators point to a bullish backdrop:

- Rising M2 money supply: Fueling risk-on sentiment.

- Easing US-China trade tensions: Reducing global market uncertainty.

- Rate cut optimism: Analysts eye September for a potential Fed pivot.

But there are also warning signs.

Bitcoin’s relative strength index (RSI) briefly crossed above 70 earlier this month — signaling overbought territory. This could indicate a short-term correction, particularly as BTC displays bearish divergence — a rising price paired with a falling RSI.

If a pullback occurs, Bitcoin may revisit support levels in the $92,400–$95,000 zone before any breakout continuation.

What’s Next for BTC Price?

Traders and analysts remain divided. Some see the golden cross as a setup for a push toward $150,000, while others advise caution due to near-term exhaustion.

“The golden cross is bullish, but don’t ignore the RSI,” said a TradingView analyst. “We may need a cooldown before the next leg higher.”

With Bitcoin nearing its highest weekly close ever, volatility remains elevated — and the path to new all-time highs may still include a detour.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a professional before making investment decisions.