In the wild world of crypto trading, emotions can be your biggest enemy. That’s why seasoned Bitcoin traders rely on automated tools like stop-loss and take-profit orders — not just to maximize gains but to sleep peacefully at night.

These orders act as pre-set instructions on trading platforms like Binance, Coinbase Pro, or Kraken. They automatically close a trade once the price hits your target or bottom line. Whether you’re hedging against a crash or cashing in during a pump, this is your first line of defense.

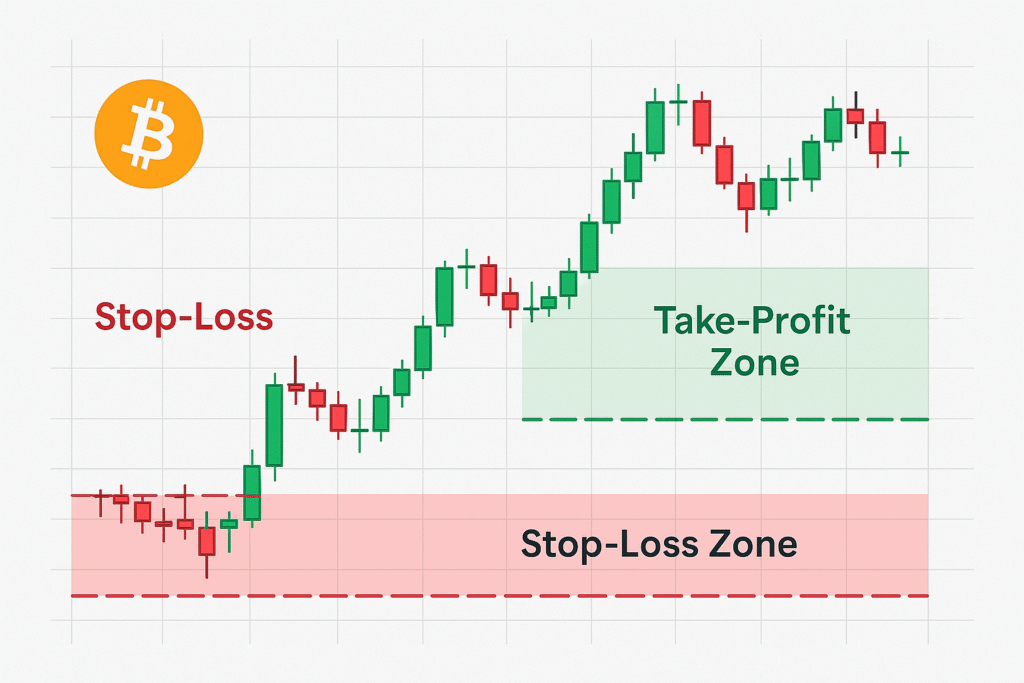

What Is a Stop-Loss Order in Bitcoin?

A stop-loss order is your safety brake. It automatically sells your BTC if the price drops to a level you’ve defined.

Example:

You bought 1 BTC at $90,000 and set a stop loss at $85,000. If Bitcoin dips to $85,000, your trade closes — limiting your loss to $5,000.

Pro Tip: Avoid placing stops at obvious levels like $85K or $90K — bots love to hunt those. Instead, use $84,800 or $89,700 to stay under the radar.

What Is a Take-Profit Order?

A take-profit order automatically sells your BTC when it reaches a target price, locking in your desired gains.

Example:

Bought BTC at $90,000? Set your take profit at $95,000. When BTC touches $95K, your position closes in profit — even if you’re asleep.

Greed Control: Don’t wait for BTC to hit the moon. Lock in solid wins and walk away stronger.

How to Set Stop-Loss & Take-Profit on Bitcoin Trades (Step-by-Step)

- Pick a Trading Platform: Use trusted platforms like Binance, Kraken, or Coinbase Pro.

- Open a BTC Trade: Buy or short BTC (e.g., Buy at $90,000).

- Set a Stop-Loss: Choose your max loss level (e.g., $87,300 = ~5.6% drop).

- Set a Take-Profit Target: Define your exit profit (e.g., $94,500 = 5% gain).

- Confirm & Monitor: Review, confirm, and stay alert. Market alerts help too.

Pro Tips for Smarter BTC Order Placement

- Use Volatility Indicators like ATR (Average True Range).

- Respect Support Levels but set stops slightly below them.

- Avoid Panic Edits – especially during flash crashes or news events.

- Watch Out for Slippage in high-volume markets.

Trailing Stop-Loss: A Smarter, Dynamic Strategy

Want your stop-loss to move with the market? Use a trailing stop-loss.

Example: Bought at $90,000. BTC rises to $95,000. A 3% trailing stop sets your stop-loss at ~$92,150 — protecting profits while letting the trade breathe.

When to Adjust Your BTC Orders

- Tighten Stop-Loss: If BTC jumps from $88K to $93K, shift stop to $90.5K.

- Trail During Bull Runs: Follow the uptrend, lock in more profit.

- Widen Stops in Consolidation: Avoid getting shaken out.

- Reset Take-Profit After Pullback: BTC often retraces and then bounces back.

Common Mistakes with Stop-Loss & Take-Profit Orders

- ❌ Setting stops too tight – account for 5-10% BTC volatility.

- ❌ Ignoring slippage – especially during crashes.

- ❌ Chasing round numbers – bots will find and trigger them.

- ❌ Forgetting to adjust orders after big moves.

- ❌ Panic-canceling – let automation save you from emotions.

Final Thoughts: Trade Smarter, Not Harder

Stop-loss and take-profit orders aren’t magic — but they’re your best bet at navigating Bitcoin’s volatility without making emotional mistakes. They protect your capital, lock in profits, and let you breathe between trades.

In crypto trading, it’s not just about profits — it’s about protecting your downside.

Tools You Can Use:

This article is for informational purposes only and does not constitute investment advice. Always do your own research before making financial decisions.